Ready to crunch the numbers?

Discover how much you could borrow in just a few clicks with our calculators.

Home loans, commercial property loans and SMSF loans tailored to you

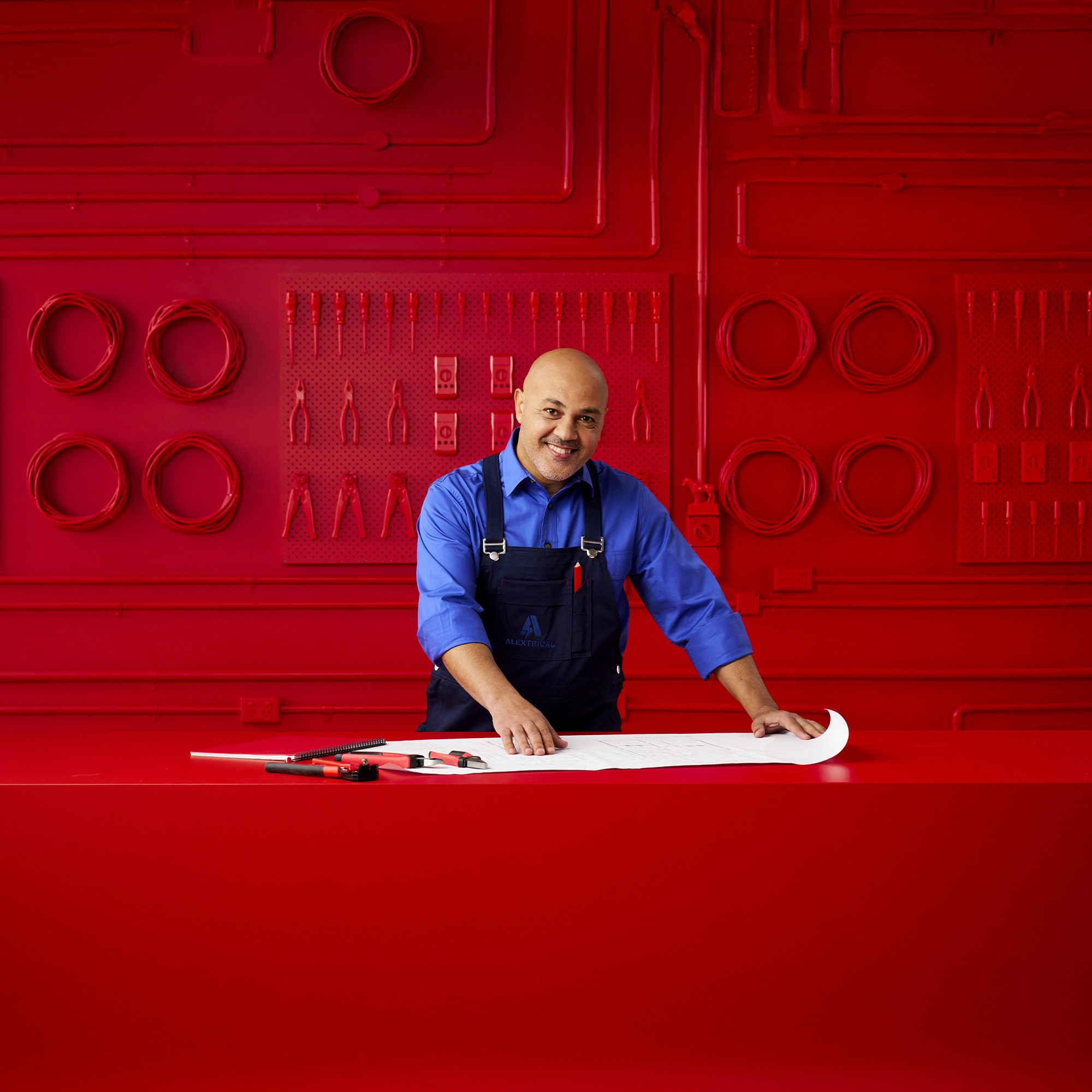

It makes no sense that business owners should find it more difficult to get a home loan than their employees do.

Our flexible income verification options cater to the different ways business owners pay themselves and any bumps they may have had along the way.

RedZed gives credit where credit's due. Our loan applications are assessed by real people, and we don't use automated computer credit scoring programs to decide if we should lend you money.

Our range of loans

We offer a variety of loans for the self-employed including home loans, commercial loans and SMSF loans. The best part is we take a holistic, common-sense approach to business and income and allow you to verify your earnings in different ways.

Home loans

• Loans up to $5m

• Access equity in your property (cash out) for personal or business use

• Wide range of income verification options

Commercial loans

• 30-year loan terms with no annual reviews

• Short-term loans for urgent needs

• Wide range of income verification options

SMSF loans

• Residential and commercial property purchases

• SMSF loan refinancing

• Competitive pricing to help boost investment portfolios

Here's what they say about us

Our customers rate us 4.2 out of 5 on Google. Find out today how we can help you.

Why choose us?

We answer the phone, we use common sense and we look at more than just the numbers on your annual tax return.

Simple

We make applying for loans simple. No hoops, hurdles or headaches, just seamless lending experiences.

Fast

We are efficient under pressure. Providing speedy responses and fast loan approvals is what we do.

Fair

We assess each application on merit and take the time to understand your business and income before making a decision.

Everyone loves a freebie

Introducing RedZed Benefits, a program that was created to offer big-picture, long-term support to hardworking people like you.

Have a burning question you want answered?

We thought you might. Check out our FAQs below to see if we've already answered the question on your mind.

We offer home loans, commercial property loans and SMSF loans. All of our loans have interest rates that are variable. We support self-employed Australians that have perfect credit histories right through to those who have had a couple of hiccups along the way.

With RedZed, you have different options to prove your income. You can verify your earnings the traditional way (using your latest individual and company tax returns and ATO Notice of Assessment) or through one of our alternative methods. If your taxes aren’t up to date, your income is seasonal, or your financials don’t tick the banks’ rigid boxes, you can prove your income by providing a self-certified income declaration. This must be supported by either:

- an accountant’s declaration

- your two most recent Business Activity Statements (BAS) along with a copy of your individual and business ATO portal information

OR

- at least six months’ worth of Business Bank Statements along with a copy of your individual and business ATO portal information.

A big part of the loan application process is proving that you can pay the loan back. We love giving self-employed Australians the chance to achieve their dreams, whether that be buying homes, growing businesses or boosting retirement nest eggs. However, we need to provide loans in a responsible manner to ensure our customers don't take on debt they can't afford.

Most of our loans require you to have been in business for a minimum of 12 months, however we do have some options for those who have been operating for a shorter period of time. Chat to one of our lending managers to find out what’s possible!

We are FAST! It’s one of our strengths. Generally speaking, the process takes approximately 3 to 4 weeks all up, however there are lots of people involved in the lending process e.g. valuers, accountants, conveyancers, financial planners etc. This means that sometimes we can’t control how fast things move. We recommend providing all the required documentation to your broker or to us as quickly as you can, to give yourself the best chance of a speedy outcome.

No. RedZed offers secured lending options for residential properties, commercial properties for individuals, trusts and companies, and self-managed super fund borrowers in Australia.

Yes, we are proud to be an Australian-owned and operated company. Our Australian-based customer service team are ready to help you and there are plenty of ways you can get in touch:

Call us on 1300 722 462 on weekdays between 8.30am – 6.30pm

Calling from overseas? Ring +613 9605 3500

Or email us at clientservices@redzed.com

We’ll get back to you within 24 business hours.

But wait, there's more

Announcing the Whitepaper — Women’s Role in Australia’s Financial Future

What the future holds for customers who choose RedZed